Understanding Real Property Gains Tax (RPGT) in Malaysia

Real Property Gains Tax can affect the net amount you take home from selling a property. Knowing how RPGT works, and how exemptions apply, can help you make informed decisions.

KL Lee

11/18/20244 min read

Understanding Real Property Gains Tax (RPGT) in Malaysia

If you’re planning to sell property in Malaysia, it’s important to understand Real Property Gains Tax (RPGT). This tax can affect the net amount you take home.

Knowing how RPGT works, and how exemptions apply, can help you make informed decisions.

Here are things you need to know about RPGT, from its origins and calculation methods, to tips for sellers.

What is RPGT?

RPGT, or Real Property Gains Tax, is a tax imposed on gains made when selling real property.

It applies to:

Residential properties like houses, apartments, and condominiums.

Commercial properties such as offices, shop lots, and industrial units.

Land, whether developed or undeveloped.

A Quick History of RPGT in Malaysia

This tax was introduced to control speculation in the property market and stabilise prices.

RPGT first appeared in 1974 under the Land Speculation Tax Act and later developed into the Real Property Gains Tax Act 1976. Over the years, the government has fine-tuned RPGT rates to reflect property market conditions.

For example, during challenging economic periods, the government would briefly exempt RPGT to encourage property transactions.

However, as market stability returned, RPGT was reintroduced with adjusted rates.

Who is Subject to RPGT in Malaysia?

RPGT applies to three categories of individuals and entities:

Malaysian citizens and permanent residents

Non-citizens

Companies

Regardless of your status, understanding the RPGT rate that applies to you is crucial for effective financial planning.

How is RPGT Calculated?

Calculating RPGT may look complicated at first, but it follows a straightforward formula:

(Disposal price - Acquisition price - Allowable expenses + Recoveries) × RPGT rate = Tax payable

Key definitions to know:

Disposal price: The selling price of your property.

Acquisition price: The original purchase price of the property.

Allowable expenses: Costs that can reduce your taxable gain, such as legal fees, stamp duty, renovation costs, and estate agent commissions.

Recoveries: Gains that can increase your taxable gain, such as forfeited deposits, insurance compensation, and compensation for damages to the property.

Understanding the Disposal Date and Acquisition Date

The disposal date of the disposer is when the agreement to sell (Sales and Purchase Agreement or SPA) is signed. If no agreement exists, it’s either:

The date ownership is transferred, or

The date full payment is received, whichever is earlier.

Generally, the acquisition date of the acquirer coincides with the disposal date of the disposer.

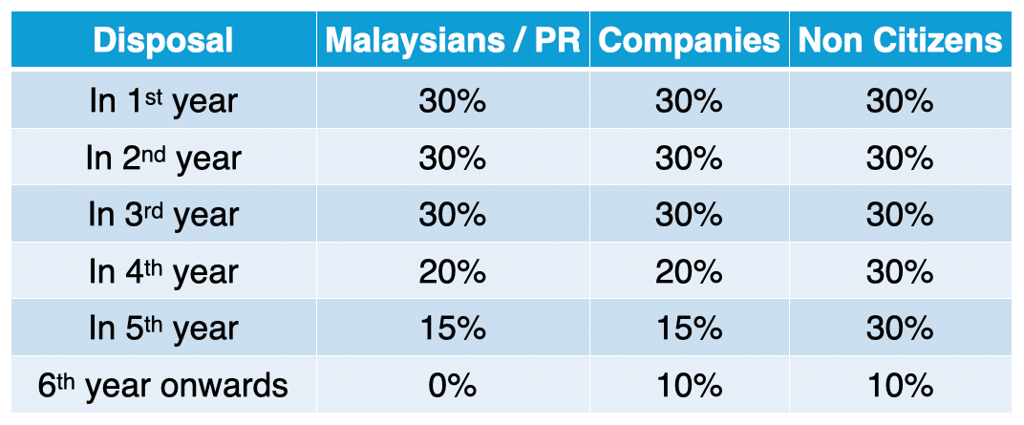

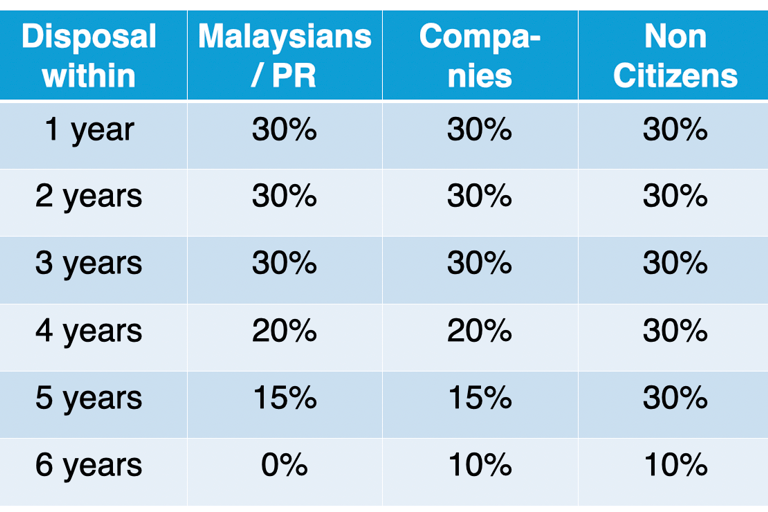

RPGT Rates in Malaysia

RPGT rates vary according to the seller’s residency status and the holding period of the property:

Recent Updates

Since 1 January 2022, Malaysians and permanent residents enjoy full exemption from RPGT when selling property after the fifth year of ownership.

RPGT Exemptions You Should Know

Several exemptions can lower—or eliminate—your RPGT liability:

Once-in-a-lifetime exemption. Malaysians are entitled to an exemption on the sale of one private residential property sale in their lifetime.

Gifts between family members. Transfers between spouses, parents and children, or grandparents and grandchildren are considered as “no gain, no loss” transactions.

General exemption for individuals. RM10,000 or 10% of the chargeable gain—whichever is greater—is exempted.

Special exemptions

Inheritances are considered as “no gain, no loss” transactions.

Disposals to the government or charitable organisations.

Properties transferred under a Syariah-compliant financing scheme.

“No Gain, No Loss” Transactions

Certain transactions are exempt from RPGT under the “no gain, no loss” provision.

These include:

Transfers between spouses or immediate family members.

Inheritance.

Transfers to a government body or tax-exempt charity.

Property transfers because of compulsory acquisition or financing arrangements under Syariah principles.

Tips for Sellers to Minimise RPGT

Claim all exemptions. Ensure you utilise your once-in-a-lifetime exemption for a private residence.

Track your expenses. Keep receipts for renovation, legal fees, stamp duty, and estate agent fees—they can reduce your taxable amount.

Plan your sale. If possible, hold on to your property for over five years to enjoy full RPGT exemption if you’re a Malaysian or PR.

Consult a professional. Engage a tax consultant or property agent to navigate RPGT rules and avoid penalties.

Why Understanding RPGT Matters

RPGT directly affects the profit you make from selling your property in Malaysia.

A clear understanding of how it works ensures you’re well-prepared to manage costs and maximise your returns.

Are You Planning to Sell a Property?

Contact us today to learn how we can support you with your property goals!